There are many different charges you can add to a Tariff, which in turn will appear on the bill.

You would create one Tariff with many Cost Definitions. can also add additional information to the bill to show a description of the charges.

The Tariff is held under the Contract, and the Cost Definitions can be under the Organisation, Site, Meter etc. It is good practice to add them under the Organisation as they are then accessible in one place.

You will probably have one Contract and a few Cost Definitions attached to the Contract, for example Pence Per Unit, Standing Charge and VAT rate. On a Gas Bill, you may use Calorific Value and Temperature Pressure Multiplier figures that are used in the background to produce the Bill.

See below on how to set these up.

Cost Definition

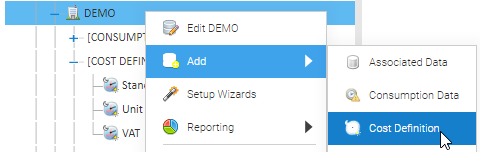

Right click on the Organisation

Click Add

Click Cost Definition

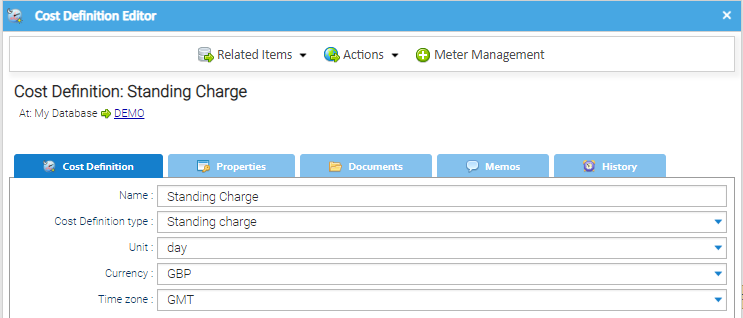

Standing Charge Cost Definition

Enter details in the Cost Definition Editor popup:

| Field | Description |

|---|---|

| Name |

...

| Standing Charge | |

| Cost Definition |

...

| Type | Standing Charge |

| Unit |

...

| Day | |

| Currency | This should be defined as Pence (‘p’) |

| Time zone |

...

| GMT. This is not applicable to Standing charges and will be ignored. |

Click

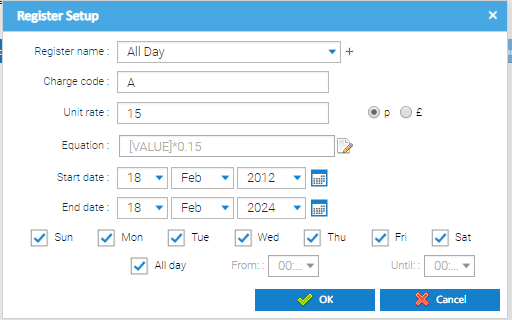

Enter details in the Register Setup popup:

| Field | Description |

|---|---|

| Register name |

...

All day. This is not applicable to Standing charges and will be ignored. | |

| Charge code |

...

| Leave blank - not required | |

| Unit |

...

| rate | The unit rate that should be used when calculating the standing charge for the applicable period. Enter the rate in pence and ensure 'p' is selected |

| Equation |

...

| will default to the value added in the Unit rate - does not need to be changed. | |

| Start date |

...

| the date |

...

| this particular standing rate is applicable from |

| End date |

...

| the date |

...

| this particular standing rate |

...

| is applicable to |

| Sun - Mon |

...

| tick the days of the week this charge applies to (in this example all days) | |

| All day |

...

Tick this box. This says the rate is applicable for all hours of the day. | |

| From and Until times |

...

| These are greyed out |

...

| as the all day box has been selected. |

Click OK to set up the tariff lineCost Definition.

Click OK to close the Cost Definition Editor popup popup .

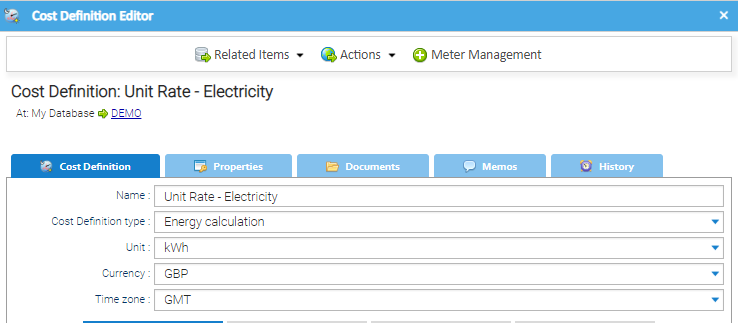

Unit Rate Cost Definition

The unit rate can be setup to calculate charges using the metered consumption.

it is possible to configure individual rates for different times of the day (e.g. Day and Night / Peak and Off-peak)

Enter details in the Cost Definition Editor popup:

| Field | Description |

|---|---|

| Name |

...

| for example, Unit Rate - Electricity | |

| Cost Definition type |

...

| Energy calculation | |

| Unit |

...

| A Unit for the Cost Definition e.g. kWh | |

| Currency |

...

Time zone: GMT

...

| Pence (‘p’) | |

| Timezone | This should match the Timezone of billing, as configured in the Billing Group e.g. GMT |

Click

Enter details in the Register Setup popup:

Single Rate Example

| Field | Description |

|---|---|

| Register name |

...

| All day | |

| Charge code |

...

A (will appear in the top section of the Sigma bill and as the first line in the Usage Charges section on the bill) | |

| Unit rate |

...

The unit rate that should be used when calculating the charge for the applicable period. Enter the rate in pence and ensure 'p' is selected. | |

| Equation |

...

| Will default to the value added in the Unit rate - does not need to be changed. | |

| Start date |

...

| The date this particular unit rate is applicable from | |

| End date |

...

| The date this particular unit rate is applicable to | |

| Sun - Mon |

...

| Tick the days of the week this charge applies to (in this example all days) | |

| All day |

...

Tick this box. This says the rate is applicable for all hours of the day. | |

| From and Until times |

...

| These are greyed out |

...

| as the all day box has been selected and the single rate applies to all times. |

Click OK to set up the tariff line.

Click OK to close the Cost Definition Editor popup popup .

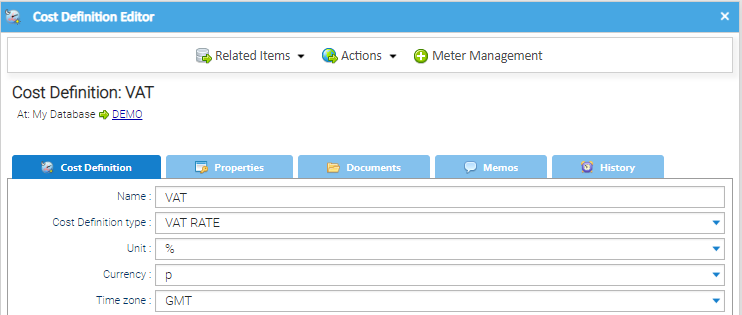

VAT Cost Definition

Enter details in the Cost Definition Editor popup:

| Field | Description |

|---|---|

| Name |

...

| VAT | |

| Cost Definition type |

...

| Must be VAT RATE | |

| Unit |

...

Currency: p

Time zone: GMT

...

| %. This is not applicable for VAT and will be ignored. | |

| Currency | p. This is not applicable for VAT and will be ignored. |

| Timezone | GMT. This is not applicable for VAT and will be ignored. |

Click

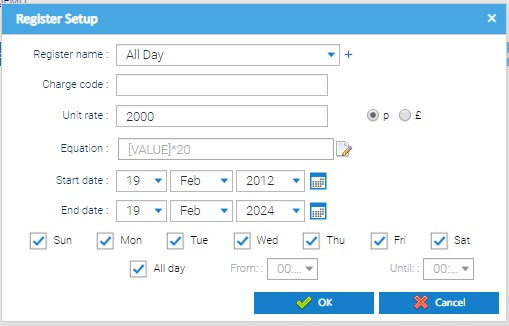

Enter details in the Register Setup popup:

| Field | Description |

|---|---|

| Register name |

...

| All day | |

| Charge code |

...

| leave blank - it is not required. | |

| Unit rate |

...

Enter the rate in pence and ensure 'p' is selected |

...

. for 20% VAT, enter 2000. |

...

for 5% VAT, enter 500. | |

| Equation | Will default to the value added in the Unit rate - does not need to be changed. |

| Start date |

...

| The date this particular VAT rate is applicable from | |

| End date |

...

| The date this particular VAT rate is applicable to | |

| Sun - Mon |

...

| Tick the days of the week this charge applies to (in this example all days) | |

| All day |

...

Tick this box. This says the rate is applicable for all hours of the day. | |

| From and Until times |

...

| These are greyed out |

...

| as the all day box has been selected and the single rate applies to all times. |

Click OK to set up the tariff line

Click OK to close the Cost Definition Editor popup

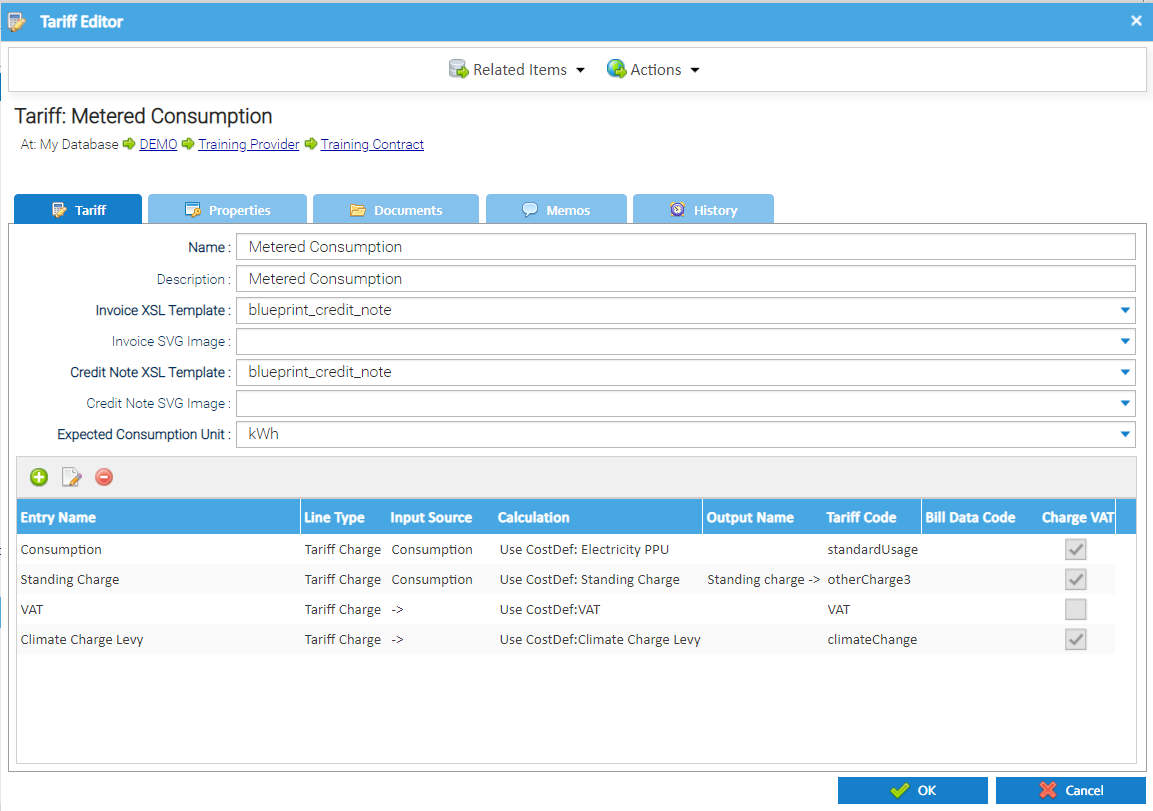

Tariff Entry Lines

Once you have Cost Definitions, you can now create the Tariff to contain one or more of the Cost Definitions. which effectively represents the list of charges that will be charged to the Tenants. These individual charges are known as Tariff Entries.

You can crate multiple different tariffs to support the different charging methodologies you may want to pass onto your tenants.

The lines in the tariff control how the charges should be created, and will be linked with the Cost Definitions which hold the effective rates that should be used.

You can select whether an individual Tariff Entry is subject to the calculation of VAT or not. Where an Entry is excluded, the VAT will not be calculated for the net value calculated for the charge line.

A Tariff is associated to a Contract which sit beneath individual Tenant Providers.

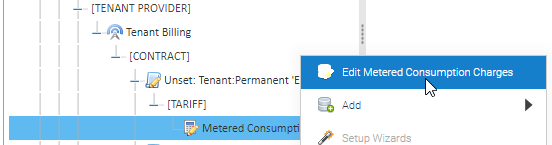

Right click on the Tariff

Click Edit

Click

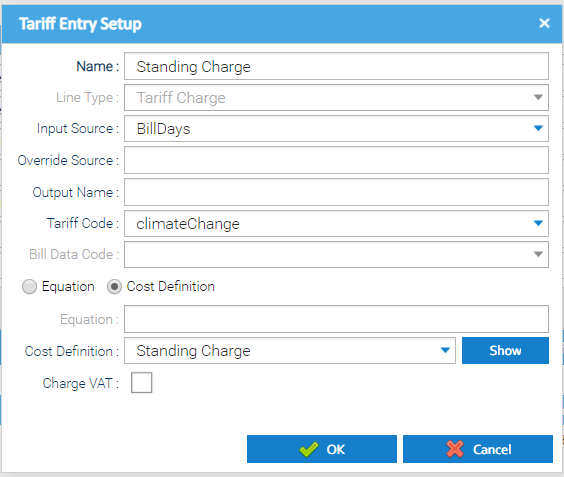

Standing Charge Tariff Entry

| Field |

|---|

Name: Enter Standing Charge

Line Type: Choose Tariff Charge

Input Source: Choose BillDays

Override Source: Leave blank

Output Name: Enter Standing Charge (if you want use the calculated value as an input to another Tariff line)

Tariff Code: Choose otherCharge1

Bill Date Code: Greyed out

Equation / Cost Definition: Tick Cost Definition

Equation: Greyed out

Cost Definition: Choose Standing Charge

...

| Description | |

|---|---|

| Name | Enter the description that you would like the charge to appear on the bill to the tenant, e.g. "Standing Charge". |

| Line Type | Choose "Tariff Charge" |

| Input Source | Choose "Bill Days" This tells the system to calculate the charge based on the number of days in the period being billed. |

| Override Source | Leave blank. |

| Output Name | Leave blank. |

| Tariff Code | Select Other Charges, and a number to represent the order it should appear on the Bill e.g. "otherCharge1" |

| Bill Data Code | Greyed out - not applicable |

| Equation / Cost Definition | Select "Cost Definition |

| Equation | Greyed out - not applicable |

| Cost Definition | Choose the appropriate cost definition that contains the rate information, e.g. "Standing Charge" |

| Show | Clicking this will allow you to see the Cost Definition (as created above) |

...

| Charge VAT | Tick this box to indicate whether VAT should be applied to the net charge calculated by this tariff line. |

Click OK to close the Tariff Entry Setup Editor

To set up another Tariff Entry, click

Alternatively, click OK to save the Tariff Entry

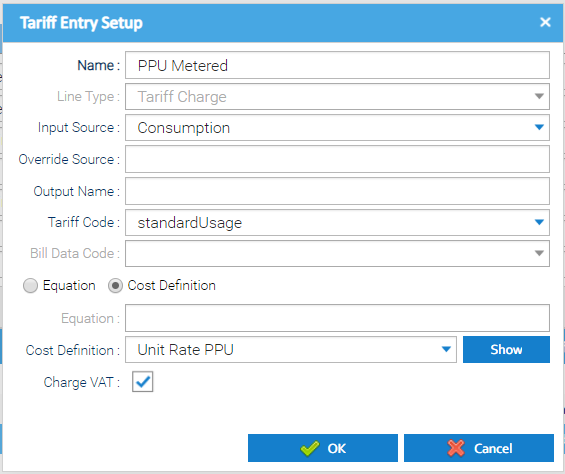

Unit Charge Tariff Entry

...

| Field | Description |

|---|---|

| Name | Enter the description that you would like the charge to appear on the bill to the tenant, e.g. "Energy Charge". |

| Line Type |

...

| Choose "Tariff Charge" | |

| Input Source |

...

Choose "Consumption" This tells the system to calculate the charge based on the metered consumption assigned to the tenant in the period being billed. | |

| Override Source |

...

| Leave blank. | |

| Output Name |

...

| Leave blank. | |

| Tariff Code |

...

| Choose "standardUsage" | |

| Bill |

...

| Data Code |

...

| Greyed out - not applicable | |

| Equation / Cost Definition |

...

| Select "Cost Definition | |

| Equation |

...

| Greyed out - not applicable | |

| Cost Definition |

...

| Choose the |

...

| appropriate cost definition that contains the rate information, e.g. "All Day Unit Rate" | |

| Show | Clicking this will allow you to see the Cost Definition (as created above) |

...

| Charge VAT | Tick this box to indicate whether VAT should be applied to the net charge calculated by this tariff line. |

Click OK to close the Tariff Entry Setup Editor

...

Alternatively, click OK to save the Tariff Entry

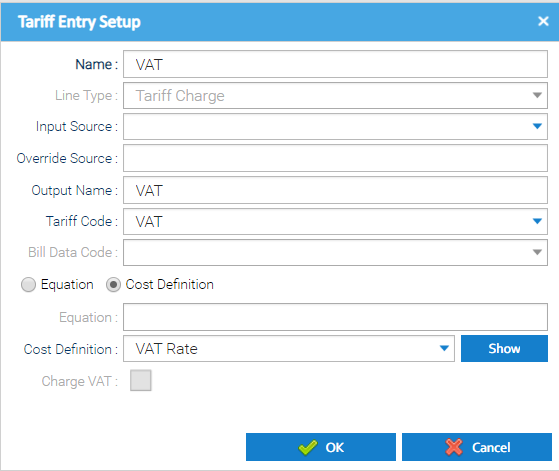

VAT Rate Tariff Entry

| Field | Description |

|---|---|

| Name |

...

| Enter the description that you would like the charge to appear on the bill to the tenant, e.g. "VAT". | |

| Line Type |

...

| Choose "Tariff Charge" | |

| Input Source |

...

Leave blank. | |

| Override Source |

...

| Leave blank. | |

| Output Name |

...

| Leave blank. | |

| Tariff Code | Choose "VAT" |

| Bill Data Code | Greyed out - not applicable |

| Equation / Cost Definition |

...

| Select "Cost Definition" | |

| Equation |

...

| Greyed out - not applicable | |

| Cost Definition |

...

| Choose the |

...

| appropriate cost definition that contains the VAT information, e.g. "VAT" | |

| Show | Clicking this will allow you to see the Cost Definition (as created above) |

...

| Charge VAT | Greyed out - not applicable |

Click OK to close the Tariff Entry Setup Editor

...

Alternatively, click OK to save the Tariff Entry

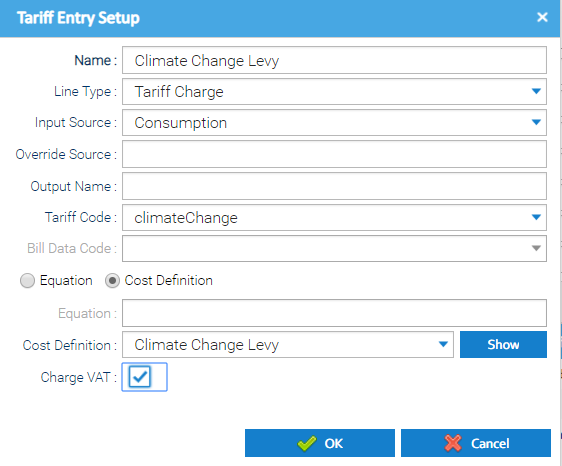

Climate Change Levy

...

| Field | Description |

|---|---|

| Name | Enter the description that you would like the charge to appear on the bill to the tenant, e.g. "Climate Change Levy". |

| Line Type |

...

| Choose "Tariff Charge" | |

| Input Source |

...

Choose "Consumption" |

Override Source: Leave blank

Output Name: Enter CCL (if you want use the calculated value as an input to another Tariff line)

Tariff Code: Choose climateChange

This tells the system to calculate the charge based on the metered consumption assigned to the tenant in the period being billed. | |

| Override Source | Leave blank. |

| Output Name | Leave blank. |

| Tariff Code | Choose "climateChange" |

| Bill Data Code | Greyed out - not applicable |

| Equation / Cost Definition |

...

| Select "Cost Definition" | |

| Equation |

...

| Greyed out - not applicable | |

| Cost Definition |

...

| Choose the appropriate cost definition that contains the climate changel levy information, e.g. "CCL" | |

| Show | Clicking this will allow you to see the Cost Definition (as created above) |

...

| Charge VAT | Tick the box to indicate whether VAT should be applied to the net charge calculated by this tariff line. |

Click OK to close the Tariff Entry Setup Editor

...

Alternatively, click OK to save the Tariff Entry

Tariff Editor

Once you have created all the Tariff Entries (with Cost Definitions), click you will see that they all appear as a list of configured tariff entries.

Click OK to save.